Skip to main content

WHY DOES STOCK MARKET GOES UP AND DOWN ?

WHY DOES MARKET GOES UP AND DOWN ?

THE KEY TO MAKING MONEY IN STOCKS IS NOT GET SCARED OUT OF THEM.

- PETER LYNCH

As the topic suggests, most of us have seen the fluctuations happening in the market always. Daily we keep hearing that market is up by certain percentage and next day it would have fallen for certain percentage. Same happen with stocks too.

We know that stock is a kind of investment. We also know that FD is another kind of investment, which gives you 5% to 6% consistent returns in a year. And we have observed that stocks of the company may fluctuate by 3% to 7% in a day itself.

Go and check out the NSE website. You see that certain stocks are up by 5% to 7% in a day itself. Someone who would have invested into that particular stock yesterday would have already made 7% returns. WOW! For a moment everyone would have thought that you could become rick quickly then. But do you think it's possible every time to pick up such kind of stocks? Obviously not !

Predicting future is something near to impossible. The stock market is all about predicting the future or calculating the future value of the stocks and then investing in those stocks.

So the fluctuations in the stock prices is very common in the stock market and such scenario makes the novice become nervous and other way it makes the people to start trading in the stock market.

At the end of the day everyone are trying to predict the market if they are trading. However if you are an investor you will look into the actual valuation by doing intrinsic or actual valuation and make the best portfolio and risk management.

Since stocks fluctuate a lot, it goes up and down a lot. Many people start to trade in it. And some wait for the right price to come. So stock market works on future performance only.

Whatever happened with the company is public information. Everyone knows that, the companies listed in the market have made certain revenue, good clients, certain profits and that's why they are valued in the market.

But whether they will grow from here is a point of analysis. From the analysis we should find out if the company will survive for longer period or beat the competition in the market or will they be able to give similar cutting edge products or services to the clients in future as well.

So predicting about the future performance of the company is always taken into consideration by both traders as well as investors. Predicting the future for the next 10 to 15 years is very difficult and once you bring it down for today's time, then you see that fluctuation in the market becomes inevitable and it has to happen.

It's very important to know that these kinds of fluctuations will be there when you are going to invest in the stock market and you need not have to worry. If you are an investor for the long term, these 5% to 6% fluctuations in the stocks or 3% to 4% in the NIFTY or the SENSEX is not going to give you bad returns. This fluctuation is the nature of the businesses, nature of this stock market.

BOOK VALUE

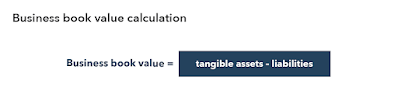

Book value is the exact value of the company at which it stands today. It represents the total amount a company at which it stands today. It represents the total amount a company is worth if all its assets are sold and all the liabilities are paid back.

Let us take a example of Larsen and Toubro Ltd. Now we saw that if we calculate the book value and the total profits of the last four quarters of LT, it is getting the returns at 15% on the company.

But if you had divided the LT's total profit of the year to the market cap value, you will see that hardly 5% return is there. So you would always wonder and question that even with such a huge market cap why it's making such a less profit. So idea here is you need to look at what is the capital which is deployed i.e. the book value and not the market cap value for calculation.

The concept of BETA

Beta is nothing but a measure of particular stock's volatility in relation to the market. High-beta stocks are supposed to be riskier but provide higher return potential as compared to low-beta stocks that provide lower returns. You can Google and check the beta stocks in Indian stock market to get a complete list. They fluctuate lesser than even the indexes.

If you look at companies which are more stable and predictability of business is very high ,such companies will have lower beta and they will fluctuate lesser than the market. So there are companies which has beta lesser than ever 1.

Think like nifty goes 1% up, this stocks will also go 1% up, or fall to 1% then this too shall fall to 1%. In that case you say beta of the company is 1.

There are also companies which fluctuates more than the market, there beta will be higher.

UPPER CIRCUIT/ LOWER CIRCUIT

If you are someone already in the market, you would have heard of situations like market getting halted for certain minutes or hours or sometimes the whole day by the exchange, due to high volatility.

Since we have lot of unpredictability in the market, stock exchanges try to correct it by keeping certain limits

The stocks exchange has fixed certain limits to the stocks above/ below which it cannot trade in the market and these are called upper/lower circuit. And the limits framed are called as circuit limits.

Let's within certain time frame, market opened and went up by 10% then exchange will halt the trading for certain minutes and reopen later. If the circuit is again going up for next 5%, then they will again stop for more time period. Probably if the third circuit happens, trading will be stopped for the entire day.

Similarly it happens with stocks also. And there are different kinds of upper and lower circuit defined for different stocks and the exchange.

CONCLUSION

I hope now you can explain someone when they ask you why the market goes up or down!

The price of the stocks gets determined in the present because of the future expectations from the company. This is the reason why it's impossible to predict the future expectations form the company. This is the reason why it's impossible to predict the future; we can only go close to it. Just because of this factor you see that the market fluctuates up and down.

But neither do I recommend you to take advantage of it and become an intraday trader nor to worry about it. Always wait for your prices to arrive.

There is no right or wrong time to enter or exit the market.

And don't worried or hyper excited from the market.

All you have to do is keep investing in the valuable stocks.

Keep developing your portfolio.

Maintain discipline.

Comments

Post a Comment